Coking coal suppliers raise prices, seeing high demand from China Far east / Coal

December 19, 2019

Buyers accept higher scrap tags in Taiwan, delay bookings in Korea Far east / Scrap

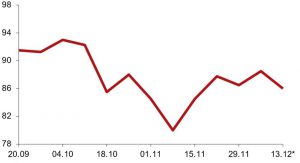

December 19, 2019Iron ore benchmark price remained unchanged for the second consecutive day on steady futures, though weaker trade raised concerns over a forthcoming decrease.

Australian iron ore fines 62% Fe were still at $88.5/t CFR as the tags in January contracts on the DCE showed almost no change during the last two days. Suppliers continued to hold their offers, though purchasing activity dropped significantly, compared to Wednesday and Thursday. The only deal reported on a platform was done for Australian Newman fines.

Lower demand raised worries that the raw material price could go down in the near future. “Iron ore is unlikely to sustain in December, though the decline should not be as sharp as previously expected because of high consumption resulting from

easy production cuts,” a Chinese analyst told Metal Expert. Iron ore quotations at ports have already fell by RMB 5-15/t ($0.7-2.1/t) due to softer buying.

The world’s largest agencies, as before, predict that iron ore demand will drop in China next year. However, some of them say the prices will remain high due to supply issues. “Despite the weak demand, prices of iron ore may remain solid in 2020 as the supply is relatively tight on the global market,” said JP Morgan. The firm maintained its raw material price forecast at $81/t CFR on average for H1 2020.

China: deals For Iron ore, $/t

|

Products |

Fe, % |

Sale method |

Volume, t |

laycan | Price, CFR Qingdao | Price, FoB |

| Newman fines, Australia | 62 | globalore | 100,000 | January 8-17 | 88.2 | 77.9 |