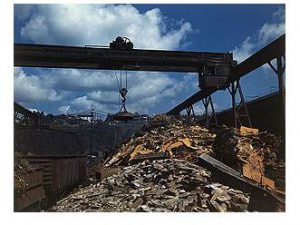

Domestic scrap prices increase further in turkey on costlier imports turkey / Scrap

November 2, 2019

Russian scrap export prices rise on stronger demand from turkey

November 2, 2019China books first HRC import batch

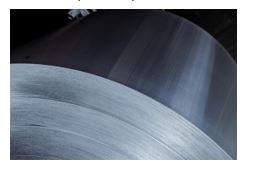

last week, a major Chinese trader concluded an import deal for Korean HRC, which became the first such deal in years. More import is seen in the segment, and more semis will be bought overseas in the coming months.

One of the biggest state-owned trading companies booked 32,000 t of SAE grade HRC at $419/t CFR Southern China from South Korea for November shipment last week, Metal Expert learnt from the importer directly. The most part of that quantity has already been sold by the trader in the local market to Chinese end-users, while some volumes are still under negotiations.

Prices for imported HRC for early-mid December delivery are more profitable for Chinese producers of CRC and coated steel, especially in the Southern part of the country, where domestic quotes are higher than in the North.

Many market insiders outside China believe that Chinese import is temporary and should end very soon, but “it seems there will be even more room for import

during the winter,” a Chinese steelmaker told Metal Expert. He also noted that his company was recently considering slab purchases in overseas markets, because of plans to hold maintenance of some furnaces in November and December. “We can switch to imported semis any time. The only issue is a price. It is not attractive enough at the moment,” a major privately owned steelmaker in Jiangsu province told

iron ore stays on downward track on pessimistic moods

Iron ore price dropped further on Monday in line with insiders’ expectations, being pressed down by negative market moods and sluggish demand.

Australian iron ore fines 62% Fe fell by $0.75/t to $84.75/t CFR while the futures on the DCE lost RMB 4.5/t ($0.6/t) from the Friday level. The decrease was last- ing for the fourth working day in a row as the worries about supply recovery and demand slowdown weighed on the market. “General expectations are not very optimistic. Iron ore demand will keep softening due to weaker steel segment,” a Chinese trader told Metal Expert.

As it was reported, last week China’s government announced winter output cuts for large northern steelmaking cities. Besides, two major iron ore miners Vale and Rio Tinto revealed an increase in the raw material production in Q3, adding to glob al supply growth concerns.

Seaborne purchasing activity was close to zero on lackluster sentiments. No deals were done on trading platforms during the day. Mills were mostly buying small volumes from ports according to their current production needs. Prices in the national currency were fluctuating slightly in different directions, insiders say.

Japan’s steel export gains 14% in September

Japanese manufacturers have failed to increase steel exports in Q1-Q2 (April-September) due to tough competition in the region, but managed to boost overseas sales in September. The expectations for Q3, however, are dim.

In April-September 2019, export shipments of steel products from Japan were about 17.65 million t, down 1.3% year-on-year, according to the preliminary data from the Ministry of Finance (METI). Local manufacturers boosted supplies only to South Korea (2.9 million t, up 11.5% y-o-y), to the EU (157,000 t, up 7.9% y-o-y) and to the Middle East (516,000 t, up 37% y-o-y) while exports to all other countries declined.

Export activity showed better results in September, reaching 13.8% y-o-y growth at 3.04 million t. Japanese mills managed to increase sales to all main destinations. The biggest growth was seen in the Middle East (58.7%), the EU (47.8%) and South Korea (by 18.8% to 492,000 t), Metal Expert leant.

Although Japanese manufacturers performed better in September, the expectations are not very positive. The Japanese steel industry will face limited demand from both local and foreign customers in October-December, according to METI. Export shipments will total 7.19 million t in Q3 of this financial year, 1.4% down year-on- year, Metal Expert reported. Japanese sellers continued to reduce HRC offers to foreign customers, but in early October it was difficult for them to boost sales, since Russian and Indian suppliers were offering more competitive prices in South- east Asia.

Only flats output rises in China in September despite crude steel cut

Rebar output dropped in China last month, following crude steel output reduction. Flat steel makers, however, increased production as more capacities were commissioned.

Chinese rebar makers produced 21.3 million t in September, which was 2.9% below August level, according to the latest data published by National Bureau of Statistics of China (NBS). However, the rebar share in total crude steel production even slightly rose to 25.7% from 25.1% in the previous month, as crude steel output fell by 5% to 82.77 million t in September.

A sharper rise of share in China’s product mix was seen in flat steel making. HRC added 0.9 p.p. reaching 15.9%, while the physical volume went up by 0.3% to 13.2 million t. CRC production surged the most – by 6.7% to 2.9 million t. “More HR lines were launched in Q3 in China, which pushed total output up again and put more pressure on market prices,” major steelmaker in Eastern part of the country told.

Wire rod and welded pipes production dipped by 1.7% and 2.7% to 13.76 million t and 5 million t, respectively.

tata Steel cuts CRC output in April‑September

Tata Steel reduced capacity utilization rates at the 300,000 tpy cold-rolling complex at Tarapur steel plant in Maharashtra state. “The slowdown in the auto sector has impacted us for the past six months. Our capacity utilization, which used to be 100% last fiscal year has come down to 85%,” said the head of Tata Steel cold

rolling complex Ujjwal Desai, quoted by local mass media.

The Indian automotive sector kept posting weaker results over the first six months of this financial year. In April-September, total vehicle production declined by 13.3% year-on-year, whereas the sales of passenger vehicles went down by 23.6% y-o-y, the Society of Indian Automobile Manufacturers reported.

The expectations for the future performance of the industry are cautiously optimistic after total vehicle production and sales rose in September in a monthly comparison. The festive season and pre-buying ahead of the price rise starting April 2020 after the enforcement of the BS-VI emission standards are among the main factors to help boost the local vehicle sales in H2 of this financial year (October-March).

Tata Steel is now working on the construction of the new 2.2 million tpy cold rolling mill at Kalinganagar plant. For now, the steelmaker is capable of producing up to 3 million t of CRC annually at Jamshedpur and Tarapur mills, and Tata Steel BSl, Metal Expert understands.

CIS billet export prices inch up in new deals

Bullish moods in the CIS billet export segment have brought some fruits to sup- pliers, supported by limited billet availability and the uptrend in the scrap market. While the sellers did not reach their initial targets, they still fixed higher levels in new contracts.

Certain tonnages of CIS billet were sold to foreign buyers at the end of past week and early this week, making up to 25,000 t in total, Metal Expert learnt. While the last-week deal was closed at around $355/t FOB for November shipment, a more recent contract was signed with a trader at $360/t FOB. Thus, the producers inched up deal prices from the previous levels. At the same time, they did not reach their targets in offers, which strengthened to $360-370/t FOB Black Sea for November-December shipment last week after the upturn in the scrap segment in Turkey.

Further outlook for the CIS billet export segment remains blurry as there are market factors which could direct developments in different ways, both positive and negative. “We think this rush in the scrap segment is temporary and so it will dip sooner or later,” a market insider said. In such conditions, Metal Expert decided

to keep daily price assessment for CIS billet exports at $360/t FOB Black Sea on October 21.